Car Excise Tax in Poland: The Complete 2025 Guide

Firma świadczy usługi w zakresie akcyz, rejestracji samochodów i ubezpieczenia. Profesjonalne doradztwo i szybka obsługa.

Zadzwoń do nas

Napisz do nas

kontakt@akcyzawarszawa.pl

Zostaw dokumenty od twojego auta ekspertom - Akcyza warszawa

O Firmie

s

Właściciel serwisu: Mariola Ślęczkowska

REGON: 141314025

NIP: 4960058650

Adres biura

Aleja krakowska 157 02-180 Warszawa

If you’re thinking of importing a car to Poland, you’ll definitely come across the topic of car excise tax. Whether you’re buying your dream car in Germany, bringing a family vehicle from the USA, or just moving to Poland and want to bring your own car, this one-time tax is an essential part of the process. In this guide, I’ll explain what the excise tax on cars is, when and where it applies, how much you’ll pay, how to handle all the paperwork, and how to avoid typical mistakes. You’ll also find real examples, tips, and a comparison to other countries, all in a friendly, down-to-earth style.

What is Car Excise Tax and When Does it Apply in Poland?

Car excise tax is a one-time tax that you pay in Poland when a vehicle is being registered here for the first time. It applies both to new and used cars that are imported from abroad, whether from an EU country, the UK, the USA, or elsewhere.

The most common situations where you have to pay excise tax:

-

Importing a car from outside the EU (e.g., the USA, UK, Japan).

-

Bringing a car from an EU country (e.g., Germany, France) to Poland.

-

Registering a brand-new car in Poland (usually handled by the dealer, but the cost is included in the car’s price).

-

Receiving a car from abroad as a gift or inheritance.

If you’re buying a car that is already registered in Poland, you don’t pay excise tax again. The tax is due only on the first Polish registration.

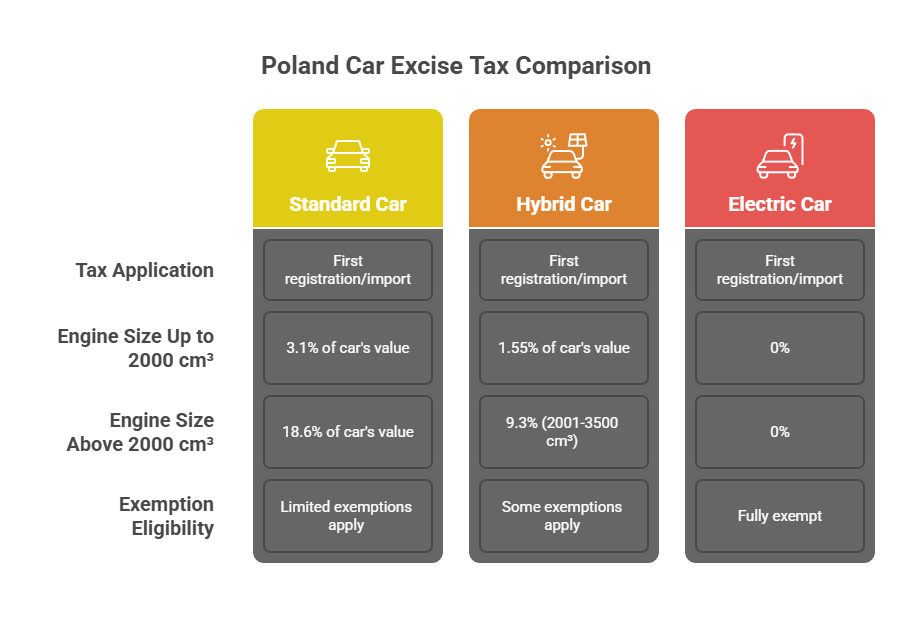

When Excise Tax is NOT Required (Exemptions)

There are a few important exceptions:

-

Fully electric cars – no excise tax at all.

-

Plug-in hybrids up to 2.0L petrol engine – 0% excise until the end of 2029.

-

Standard hybrids – reduced excise rate (1.55% up to 2.0L, 9.3% up to 3.5L).

-

Classic cars (usually over 25–30 years old, with antique/historic status) – often excise free.

-

Personal belongings when moving – if you move your residence to Poland (from the EU or outside) and bring your own car (used, owned at least 6 months before the move), you may be exempt.

-

Temporary stays – if you are only temporarily in Poland and the car stays registered abroad.

-

Special vehicles (ambulances, certain service vehicles) – exempt in specific cases.

Remember, each exemption has specific requirements and documentation, so always check the details before assuming you qualify.

How is Car Excise Tax Calculated?

There are two main factors:

-

Engine size (capacity)

-

Car type (standard, hybrid, electric, etc.)

Rates (as of 2025):

-

Up to 2,000 cm³ – 3.1% of the car’s value

-

Above 2,000 cm³ – 18.6% of the car’s value

-

Hybrid up to 2,000 cm³ – 1.55%

-

Hybrid 2,001–3,500 cm³ – 9.3%

-

Full electric cars, hydrogen vehicles, plug-in hybrids ≤2,000 cm³ – 0%

The tax base is the car’s value, usually your purchase price (invoice or sales contract), but it must be close to market value. If the tax office thinks the value is too low, they can require a correction. For damaged or unique cars, it’s wise to attach an expert’s valuation.

Currency conversion: If you bought the car in a foreign currency, use the National Bank of Poland’s exchange rate from the day the tax obligation arose (date of import or purchase).

Note: The car’s age or CO2 emissions do not directly change the excise rate, but they affect the market value.

Step-by-Step Guide: How to Pay Car Excise Tax in Poland

Timeframe: You must file and pay the excise tax within 14 days of importing the car or making the purchase.

Prepare Documents:

-

Purchase invoice or sales contract

-

Foreign registration/title

-

Proof of de-registration (if applicable)

-

Personal ID

-

Translations (if needed)

-

Customs clearance (for non-EU imports)

-

Documents proving exemption (if you qualify)

Fill Out the AKC-U Declaration:

-

Use the official AKC-U (or AKC-U/S) form for passenger cars.

-

Include your data, car details, value, engine size, and calculated excise.

Submit the Declaration:

-

Online via PUESC (https://puesc.gov.pl/) is the easiest way.

-

Or in person at the local Customs/Tax Office.

Pay the Excise Tax:

-

Pay by bank transfer to the official Customs/Tax Office account.

-

Keep the proof of payment!

Get Confirmation:

-

Download or collect the official confirmation of payment.

Use the Confirmation to Register Your Car:

-

You cannot register your imported car in Poland without proof of excise tax payment.

What Happens if You Don’t Pay or Are Late?

-

Late interest: The tax office will charge interest for late payment.

-

No registration: You cannot register the car without proof of excise tax payment.

-

Fines: Significant delays or trying to avoid the tax can lead to fines and possible legal trouble.

-

Vehicle seizure: In extreme cases, your car could be confiscated.

Tip: If you realize you made a mistake or are late, contact the tax office right away, pay the tax, and explain the situation.

Real-Life Example: Importing a 2017 BMW from the USA

Imagine you bought a 2017 BMW 430i with a 2.0L petrol engine for $20,000 in the US.

-

Engine: 1998cc, so 3.1% excise rate.

-

Purchase price: $20,000. Let’s say the exchange rate is 4 PLN/USD = 80,000 PLN.

-

Excise tax: 3.1% of 80,000 PLN = 2,480 PLN.

If the same car had a 3.0L engine, excise would jump to 18.6%: 18.6% of 80,000 PLN = 14,880 PLN.

You file the AKC-U, pay the tax within 14 days, get the confirmation, and proceed with registration.

Common Tips and Pitfalls

-

Don’t miss the deadline: 14 days is strict!

-

Declare a fair value: Don’t try to cheat – the tax office will check.

-

Keep all documents: You’ll need them at every step.

-

Use PUESC online platform: It’s faster and more convenient.

-

Leverage exemptions: If you qualify, prepare the right documents.

-

Beware of scams: Only pay the excise tax directly to the official tax office.

-

Budget for all import costs: Excise is only one part; include customs, VAT, and registration in your calculations.

Comparison: Excise Tax Systems in Other Countries

-

Poland: One-time excise (3.1% or 18.6%) on first registration/import.

-

UK: No import excise tax, but there’s a high annual road tax (Vehicle Excise Duty), especially for high CO2 cars.

-

USA: Only a small import duty (2.5%) for cars, plus state-level taxes.

-

Canada: Import duty (6.1% if non-North American), GST/HST, special excise taxes for A/C and very inefficient or luxury vehicles.

Poland’s system can be much more expensive for cars with large engines, but there are big discounts for electric and hybrid vehicles.

Frequently Asked Questions

Does excise tax apply to used cars?Yes, if they’re being registered in Poland for the first time.

Do I pay excise when importing from the EU?Yes, unless it’s your personal move or another exemption applies.

How do I pay?Bank transfer after submitting the declaration, using the account and reference number from the Customs/Tax Office.

What documents do I need for registration?Foreign registration/title, purchase contract, proof of excise tax, proof of customs and VAT (if outside EU), technical inspection, insurance, ID.

Can I get a refund if I export the car again?Yes, but only if you prove the car has left Poland permanently.

Can I drive on foreign plates before paying excise?Only for a limited time and only in specific situations. If you’re a resident, you must register the car locally and pay the tax.

How can I lower the excise tax?Choose an electric or hybrid car, opt for a smaller engine, or qualify for a personal move exemption.

7 Golden Practical Tips

-

Calculate excise in advance so you know your budget.

-

Set a deadline reminder for the 14-day limit.

-

Keep all documents organized – originals and copies.

-

Use the online PUESC platform for speed and convenience.

-

Double-check if you qualify for exemptions before importing.

-

Never trust anyone offering a “cheap fix” for the tax – only pay the official office.

-

Plan for the full cost of import: excise, customs, VAT, registration, and any local fees.

Need Help? Let the Pros Handle It

Dealing with car excise tax and registration can be confusing, especially if it’s your first time importing a car to Poland. If you want to save time, avoid paperwork stress, and be sure everything is done 100% correctly, consider using a professional service.

Akcyzawarszawa.pl specializes in handling excise tax and car registration for clients all over Poland. Their experienced team can:

-

Handle all the formalities for you, both online and in person

-

Calculate your excise tax and advise on exemptions

-

Prepare and submit all the required documents

-

Assist with customs clearance and VAT if needed

-

Take care of car registration at the communication department

-

Save you time, stress, and money

Let Akcyzawarszawa.pl take care of the whole process, so you can focus on enjoying your new car in Poland. Visit their website or contact their office for a free quote and friendly advice – in Polish or English!

Potrzebujesz więcej wiedzy?